PART ONE - MISSION, VALUES, VISION AND POLICIES

The Commission of Audit (CA) is an autonomous and independent government body of Macau Special Administrative Region (Macau SAR).

On 20 December 1999, pursuant to Article 60 of the Basic Law of Macau SAR of the People’s Republic of China and the Law No. 11/1999 of Macau SAR, CA was established with full autonomy over financial and administrative matters. CA is led by the Commissioner of Audit who is accountable to the Chief Executive of Macau SAR. The main duties of CA are:

- to audit the Macau Government’s general accounts; and

- to audit the financial operations of government departments and entities, as well as government-funded projects and organizations.

CA, being an autonomous body, has its own budget to fund its daily operations. It sets its short to medium term policies in accordance with duties and responsibilities conferred by law, and plans its annual activities accordingly.

MISSION

MISSION

As stated in the Basic Law of Macau SAR of the People’s Republic of China and CA’s Rules of Organization, its mission is to conduct independent audit on public sector organizations with respect to their utilization and management of public funds, and in particular, focusing on the legality and regularity of receipts and expenditures of public funds, the state of accounts, as well as assessing auditees’ major aspects of corporate governance.

VALUES

VALUES

CA’s core values are: professionalism, independence, objectivity and professional due care.

CA is committed to upholding a high standard of integrity and professional conduct in discharging its duties and responsibilities. It follows its core values in conducting audit assignments. CA endeavors to meet its commitments through innovative ideas and continuous improvements.

VISION

VISION

CA strives for the implementation of a comprehensive set of management processes, which not only provide transparency but are highly efficient and effective in managing public funds and resources.

CA adopts an audit methodology that is most appropriate to the changing environment, ensuring the provision of highly professional and independent audit services.

POLICIES

POLICIES

The short to medium term policies of CA are:

- Enhance the quality, timeliness and effectiveness of accounts audits – CA plans its work with reference to the requirements of the latest accounting standards and regulations, as well as experiences gained in prior years audits.

- Broaden the coverage and depth of system audits – CA hopes that, through system audits, it can help auditees strengthen their internal controls. The system audit results can also assist CA in formulating its risk-based audit approach.

- Conduct more performance audits and or special audits on government departments and entities, projects and activities in which significant public resources are being deployed and are of high public interest – CA reviews auditees’ operations and provides comments on the economy, efficiency and effectiveness with which auditees have discharged their functions.

- Research on the feasibility of conducting timely audits on large-scale infrastructure projects – CA hopes that, through timely audit, prompt release of audit findings and constructive recommendations, it can assist the Macau Government in implementing best practices on public resources management.

- Utilize the most appropriate audit methodology and techniques – CA plans its work using the most appropriate audit methodology and the latest available techniques which would enable the detection of any possible illegal and compliance issues, frauds and misconducts, misappropriation of assets and other illicit acts.

- Make effective use of latest technology in communicating with the general public and auditees, and promoting the development of internal control of public departments and entities as well.

- Increased focus on staff training – through better training programmes, CA hopes to build a highly professional team who are well equipped to meet the challenges ahead. The training programmes are designed to targeting at audit staff’s personal and professional development, and in particular, focusing on professional knowledge and technical skills required for upcoming audits.

- Strengthen relationship with other audit institutions – CA plans to maintain a closer tie with audit institutions in the Mainland, Hong Kong, Portuguese speaking countries and other countries. CA values the opportunities to meeting counterparts and sharing knowledge. Audit staff’s participation in seminars and training courses helps broaden their knowledge base, increase their understanding of the latest development in the international accounting and auditing profession.

PART TWO - ACTIVITIES, ORGANIZATION AND OPERATION, AND SOCIAL RESPONSIBILITIES OF THE COMMISSION OF AUDIT

ACTIVITIES OF THE COMMISSION OF AUDIT

ACTIVITIES OF THE COMMISSION OF AUDIT

The legal duties of CA are conferred by the Law No. 11/1999. Pursuant to that law, CA, being established as an independent government body, shall monitor the management and usage of public funds and resources. CA shall audit the Macau Government’s general accounts and the operations of government departments and entities with regards to legality, regulatory compliance, financial and management aspects of their operations.

In discharging its legal duties and responsibilities, CA carries out the following:

- Audit the financial statements of the Macau Government and issue audit report thereof;

- Conduct performance audits on auditees, assessing management performance in terms of efficiency, effectiveness and economy, and providing recommendations on areas for improvements;

- Conduct special audits on auditees, focusing on the financial results, operations, internal control environment and management performance.

CA intends to put more effort into system auditing, in particular, focusing on assessing the effectiveness of internal controls of auditees’ various operational cycles, identifying their internal control weaknesses and high risk areas, which shall then form the basis of its risk-based audit approach. Meanwhile, CA is researching on the feasibility of conducting timely audits, which would require its audit staff carrying out audit procedures upon the completion of each significant and identifiable phase of a public project. Audit procedures would cover areas such as contract execution, budget execution, financial and operational management throughout the project cycle.

Auditees

Auditees

Within the framework of the Law No. 11/1999, auditees are:

- Public departments and entities whose expenditures are integrally covered by public funds;

- Public departments and entities with more than half of their annual revenues coming from public funds;

- Other entities that do not conform to the above requirements but have given written consent to be audited; and

- Concessionaries, when the Chief Executive, by reason of public interest, authorizes, in writing, the Commissioner of Audit to do so.

Public Release of Audit Results

Public Release of Audit Results

CA publishes all audit reports.

Pursuant to its Rules of Organization and in discharge of its duties and responsibilities, CA conducts an annual audit and prepares the audit report on the general accounts of the Macau Government. The Commissioner of Audit submits the audit report to the Chief Executive. The Chief Executive shall provide the audit report to the Legislative Assembly together with the Government’s budget execution report.

Performance audit reports, upon completion, are first submitted to the Chief Executive and thereafter are released to the public.

Promotion of Audit Culture

Promotion of Audit Culture

CA has legal duties and social responsibilities to promoting transparency and diligence over the management and usage of public funds and resources. These are disseminated to the auditees throughout the audit processes.

CA adopts the most appropriate audit methodology and techniques in order to deliver quality audit services. Through the announcement of audit findings and audit recommendations, CA promotes the notion of best practice and good corporate governance.

Upon the completion of audit, CA drafts an audit report outlining the audit findings. The report is submitted to auditees for written comments. Management responses are analyzed and copy attached to the audit report which, upon finalization, is submitted to the Chief Executive.

CA believes that, full co-operation between auditees and audit staff is vital to the success of an audit. CA emphasizes that, being audited does not imply any pre-judgment on the management of auditees. Audit function has evolved as a tool for auditees to discharge their social responsibilities and managing expectations from the general public. The ultimate objective of audit function is to promote best practice and good corporate governance. Therefore, CA has regular meetings with local communities, associations and schools, sharing with them the benefits of audit and the importance of good corporate governance and better public resources management.

ORGANIZATION AND OPERATION OF THE COMMISSION OF AUDIT

ORGANIZATION AND OPERATION OF THE COMMISSION OF AUDIT

The organizational structure and functions of CA are stated in Law No. 11/1999 and the Administrative Regulation No. 12/2007.

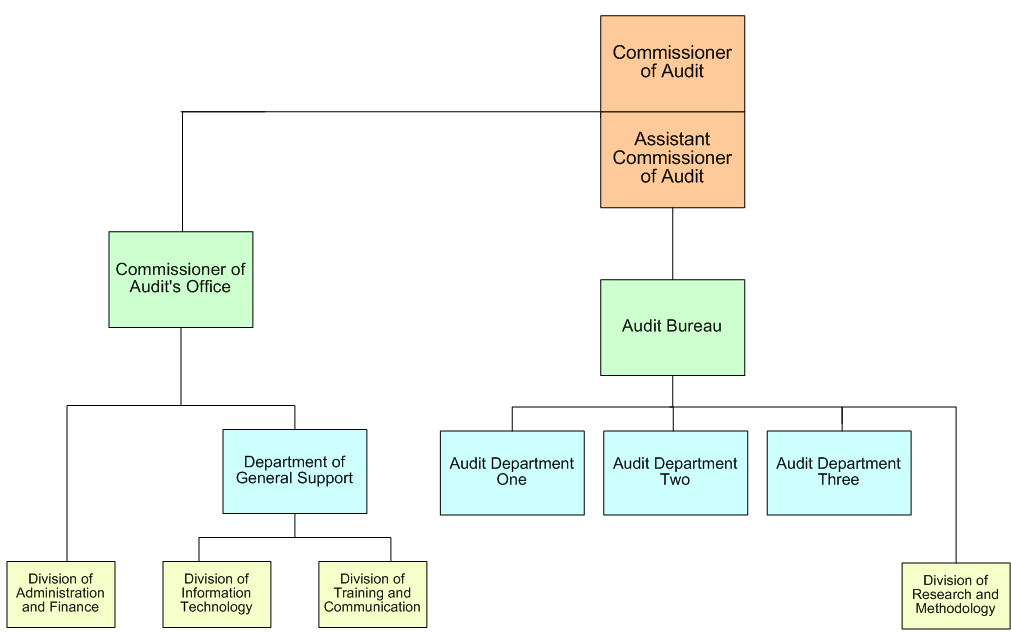

The chart below shows the organizational structure of CA, which reflects the power and duties conferred by law:

Organization and Operation of CA

Organization and Operation of CA

The Commissioner of Audit is assisted by the Assistant Commissioner of Audit, who leads and coordinates CA operations in the absence of the Commissioner of Audit.

The organizational structure of CA comprises the Commissioner of Audit’s Office and the Audit Bureau.

- The Commissioner of Audit’s Office provides technical and logistical supports directly to the Commissioner of Audit. The Office comprises the office director, advisers and secretaries. It also includes two sub-units: the Department of General Affairs and the Division of Administration and Finance.

The Department of General Affairs is responsible for providing logistic support to the operations of CA, especially in the area of information technology (Division of Information Technologies) and training, media, translation services, production of publications and promotion (Division of Training and Communication).

The Division of Administration and Finance is responsible for the execution of administrative procedures in relation to human resources, assets, budget and accounts management.

- The Audit Bureau, under the Commissioner of Audit, comprises a team of professionals and is responsible for conducting various types of audit. The bureau is led by the Director, who is assisted by the Deputy Director.

TThe Director of Audit Bureau supervises three audit departments. The functions of each audit department are summarized as follows:

- Audit Department One is responsible for auditing public institutions and departments that are established to develop the economy of Macau SAR.

- Audit Department Two is responsible for auditing public institutions and departments that are established to satisfy the public’s needs such as social security, social work, education, medical, housing and living standards, as well as their needs to participate in cultural, sport, leisure and civic activities, etc.

- Audit Department Three is responsible for auditing public institutions and departments that are established for participating in the formulation and supervision of policies of Macau SAR and ensuring the internal security. In addition, entities that are not classified as auditees of Audit Department One and Audit Department Two due to its unique nature, are under the audit scope of this department.

Under the Audit Bureau, there is the Division of Research and Methodology. The division is mainly responsible for studying, analyzing and introducing theories, techniques and methodology for the needs of the Audit Bureau, as well as assisting audit departments in performing their functions.

Financial Resources and Assets e

Financial Resources and Assets e

CA has the autonomy to handle its own financial affairs and assets. CA’s annual budget, upon compilation, shall be submitted to the Chief Executive for inclusion in the General Budget of Macau SAR. The allocated budget of CA shall then be transferred from the General Budget upon its approval by the Legislative Assembly. The Commissioner of Audit shall approve any transfer of funds within the allocated budget.

The assets of CA consist of properties and rights acquired for or in the execution of its duties.

SOCIAL RESPONSIBILITY OF THE COMMISSION OF AUDIT

SOCIAL RESPONSIBILITY OF THE COMMISSION OF AUDIT

The mission and social responsibilities of CA are to promote transparent, efficient and effective management of public funds and resources, good corporate governance in the public sectors, and working in the best interests of the Macau residents.

Upon completion of an audit, the audit report is submitted to the Chief Executive, thereafter public release takes place. CA intends, through public release of its audit reports, to raise public awareness and confidence in the role of CA. CA hopes that, through accepting its comments and implementing its suggestions, public departments and institutions can improve on their financial management and public administration.

CA periodically provides training to public departments and institutions in order to promote the audit culture, and to disseminate the notion of regulatory compliance, prudence and transparency over the management of public resources whilst upholding a standard of quality and effective services.

CA carries out regular talks at schools in order to promote audit function and audit culture, and to share audit knowledge with students. CA hopes that, through these regular talks, students can better understand the importance and benefits of audit function.

CA welcomes any suggestions, which shall be very valuable to improving the efficiency and effectiveness of public administration as well as preventing irresponsible behavior in the public sector.

CA hopes that its work and contributions can receive public recognition. CA strives to enhance high professional standards when discharging its legal and social responsibilities.